- #BLACK LITTERMAN MODEL EXCEL HOW TO#

- #BLACK LITTERMAN MODEL EXCEL CODE#

- #BLACK LITTERMAN MODEL EXCEL DOWNLOAD#

If you are a registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation.įor technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Kristin Waites The email address of this maintainer does not seem to be valid anymore. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. You can help adding them by using this form. We have no bibliographic references for this item. It also allows you to accept potential citations to this item that we are uncertain about. This allows to link your profile to this item. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here.

#BLACK LITTERMAN MODEL EXCEL HOW TO#

See general information about how to correct material in RePEc.įor technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact. When requesting a correction, please mention this item's handle: RePEc:mtp:titles:0262026678. You can help correct errors and omissions.

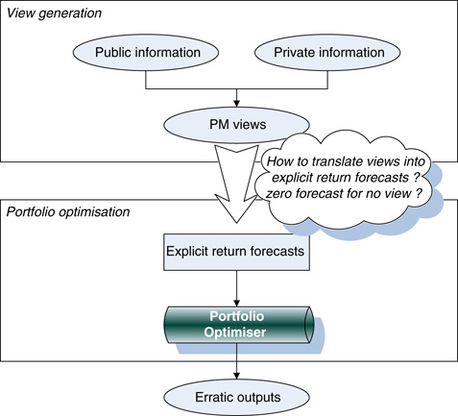

Suggested CitationĪll material on this site has been provided by the respective publishers and authors. Fundamental Models in Financial Theory is suitable for classroom use or as a reference for finance practitioners. Problems at the end of each chapter invite the reader to put the models into immediate use. The book also offers innovative presentations of the ModiglianiÐMiller model and the Consumption-Based Capital Asset Pricing Model (CCAPM). The modelÕs integration of personal views and its application using Excel templates are demonstrated. This book explores these two models in detail, and for the first time in a textbook the Black-Litterman model for building an optimal portfolio constructed from a small number of assets (developed at Goldman Sachs) is thoroughly presented. Modern financeÕs most bothersome shortcoming is that the two basic models for building an optimal investment portfolio, MarkowitzÕs mean-variance model and Sharpe and TreynorÕs Capital Asset Pricing Model (CAPM), fall short when we try to apply them using Excel Solver. Readers who have mastered the material will gain the tools needed to put theory into practice and incorporate financial models into real-life investment, financial, and business scenarios. It begins with underlying assumptions and progresses logically through increasingly complex models to operative conclusions. The book brings together financial models and high-level mathematics, reviewing the mathematical background necessary for understanding these models organically and in context. This book provides an innovative, integrated, and methodical approach to understanding complex financial models, integrating topics usually presented separately into a comprehensive whole. If you follow along and implement all the lab exercises, you will complete the course with a powerful toolkit that you will be able to use to perform your own analysis and build your own implementations and perhaps even use your newly acquired knowledge to improve on current methods.Understanding and applying complex modern financial models in real life scenarios, including the Black-Litterman model for constructing an optimal portfolio while incorporating personal views. By the time you are done, not only will you have a foundational understanding of modern computational methods in investment management, you'll have practical mastery in the implementation of those methods.

Asset se-lection is done using ETF.com’s screening tool, applying filters in line with Betterment’s asset-selection philosophy. In order to reconstruct Betterment’s approach to Black-Litterman, both Excel and Excel Solver are used.

#BLACK LITTERMAN MODEL EXCEL CODE#

In this course, we cover the estimation, of risk and return parameters for meaningful portfolio decisions, and also introduce a variety of state-of-the-art portfolio construction techniques that have proven popular in investment management and portfolio construction due to their enhanced robustness.Īs we cover the theory and math in lecture videos, we'll also implement the concepts in Python, and you'll be able to code along with us so that you have a deep and practical understanding of how those methods work. Asset Allocation with Black- Litterman in a case study of Robo Advisor Betterment. Instead of merely explaining the science, we help you build on that foundation in a practical manner, with an emphasis on the hands-on implementation of those ideas in the Python programming language. The practice of investment management has been transformed in recent years by computational methods.

0 kommentar(er)

0 kommentar(er)